If you’re leading technology, billing, customer operations, or revenue assurance in an EU/UK/US utility, you already know the uncomfortable truth: your Customer Information System (utility CIS) is either your meter-to-cash engine or your meter-to-chaos bottleneck. And the gap usually isn’t features. It’s data quality, integration, and process control.

In this article, I’ll try to explain what is CIS in utilities, how cis billing actually works, what utility customer information system integration should look like, and I’ll share a practical shortlist of cis systems for utilities (including Methodia) so you can build a defensible evaluation plan.

What Is CIS in Utilities?

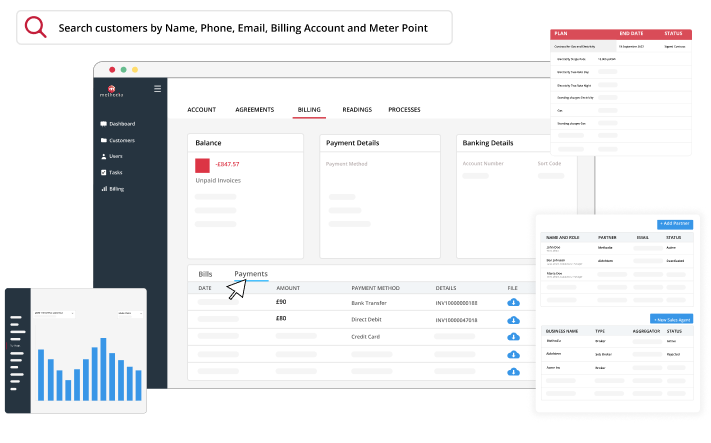

A utility customer information system (CIS) manages the internal and customer-facing account operations that power meter-to-cash functions and integrates with advanced utility customer experience and energy management. Also, utility customer information systems manage tariffs and integrate data, analytics and AI for personalized service.

That’s the definition that matters in the real world. A utility CIS isn’t just utility billing software. It’s the system that ties the customer relationship to revenue at scale, under regulatory scrutiny, with auditability.

You’ll also see CIS described as the core software utilities use to manage customer data, contracts, billing and payments, meter readings, processes, and customer service connecting front-office experiences with back-office operations.

What Does a Utility CIS Actually Do?

When people search “utility cis” they’re usually trying to understand scope. Here’s the scope I use and what I expect any energy CIS system to handle cleanly:

- – Customer & account management: Keeps a clean record of who the customer is, what services they have, and which address/service point those services belong to.

- – Rates/tariffs & billing: Applies your pricing rules (tariffs, fees, taxes) to usage so the bill is calculated correctly every time.

- – Meter-to-cash processing: Takes usage data (from meters or meter systems) and turns it into charges that can be billed.

- – Service agreements & lifecycle events: Handles different events in the customer’s journey like moving in/out or switching plans, so service and billing stay accurate.

- – Billing operations: Runs billing cycles and manages corrections like adjustments, rebills, and credits with a clear trail of what changed and why.

- – Payments & Accounts Receivable (AR): Records payments, matches them to bills, and shows what each customer still owes.

- – Credit & collections: Supports late-payment processes like reminders, payment plans, and (where allowed) disconnection and reconnection steps.

- – Customer service enablement: Gives agents the information and actions they need to answer questions fast and resolve issues without guesswork.

If any of that is mostly manual in spreadsheets, email approvals, or tribal knowledge, you don’t really have a CIS you have a billing database with a support team holding it together.

Utility Customer Information System Integration: What “Good” Actually Looks Like

This is where most articles stay vague, so I won’t.

A CIS rarely works alone. Most utilities also connect it to outage, GIS, field work, and utility asset management software so customer, billing, and asset actions stay in sync.

So, here is a realistic utility CIS integration map includes:

– Advanced Metering Infrastructure (AMI) / Meter Data Management System (MDMS) – рeal-time consumption data for billing, leak detection, and grid management.

– Customer Engagement (CRM / Self-service Customer portals) – Unified view of customer interactions, preferences, and history for personalized service.

– ERP / Finance – Accurate financial reporting, effective asset management and inventory tracking.

– Payments – Ensuring that customer payments flow seamlessly from digital portals into the Customer Information System (CIS) and finally into the ERP’s general ledger for financial reconciliation.

– Geographic Information Systems (GIS) – Links customer data to physical assets (meters, poles) for better service and outage management.

– Outage Management Systems (OMS) – Shares real-time outage info for faster response and customer communication.

If your CIS vendor tells you “we integrate with everything,” don’t celebrate. First, ask: How do you handle errors? Retries? Reconciliation? Monitoring? That’s where revenue leakage hides.

Best Utility Customer Information Systems in 2026

I’m not ranking vendors from 1 to 10 because that’s rarely how real buying decisions happen. Instead, I’m grouping CIS solutions by best fit, so you can build a shortlist that actually survives internal review.

I’m including vendors that clearly position their products as a utility CIS in their own materials.

Methodia Utility Suite

Methodia is a modular utility CIS management SaaS suite that offers comprehensive customer lifecycle and revenue management, from acquisition and switching to billing, engagement, and retention while optimizing operations and asset performance.

If you’re serious about getting the customer lifecycle and billing discipline under control, then Methodia is your go-to choice.

Hansen CIS

Hansen describes its CIS as market-tailored customer information software for utilities and also positions cloud-based CIS options for municipalities/utilities. Good to consider when you need utility-specific billing/CIS capability with a clear modernization narrative.

UMAX by Itineris

Itineris positions UMAX as a configurable CIS & CRM for utilities built on Microsoft Dynamics 365 and delivered in Microsoft Azure. If your enterprise architecture is Microsoft-centric, this alignment can simplify identity, data, and platform governance.

Oracle Utilities (CC&B)

Oracle positions its utilities customer platform as a unified metering, customer service, and billing management platform. Oracle’s CC&B is described as a customer information system designed to meet the needs of utilities of all sizes, support one to many utility service types, and handle the complexities associated with a utility’s processes.

SAP Utilities

SAP’s utilities materials describe support for core utilities processes and meter-to-cash, including managing and billing customers. SAP is most compelling when you’re already heavily invested in SAP for finance and enterprise processes and want tighter end-to-end alignment.

Gentrack

Gentrack positions its platform around billing agility (“bill anything”) and faster product/service innovation for utilities. If you operate in competitive or fast-changing markets (common in the UK and parts of the EU), that agility story can be the core requirement.

MECOMS 365 by Ferranti

According to Ferranti MECOMS 365 is a Customer Information System (CIS) designed specifically for utility and energy providers. It’s built on Microsoft Dynamics 365 and Azure services, which can simplify identity, platform governance, and integration patterns in Microsoft-heavy environments.

Cayenta CIS

Cayenta explicitly positions its Customer Information System as a customer relationship management and utility billing solution. Often relevant for municipalities and public sector-style environments where proven utility billing and customer management is the priority.

What Is the Business Impact of Utility Customer Information Systems and the Key Drivers?

BUSINESS IMPACT

When you look at a utility CIS, you don’t have to treat it as “billing software.” You should treat it as a platform that can either unlock new revenue or silently costs you money every day.

A modern CIS creates business impact in five practical ways:

Revenue growth beyond the commodity bill. A CIS becomes the platform utilities use to launch and run new digital products and services, because it ties customer agreements, usage, and charges together in one operating flow. Things like smarter bundles, flexible pricing, and customer add-ons.

Faster change without breaking billing. The more complex tariffs get (time-of-use, dynamic pricing, incentives, fees), the more you need a CIS that can handle change through configuration and governance, not custom code that becomes a burden.

Better customer engagement that actually reduces cost. When customers can self-serve and get clear, timely answers (about bills, usage, requests), you reduce avoidable contacts and improve trust. Especially under rising expectations and cost pressure.

Support for prosumers and distributed energy resources (DER). As customers generate, store, and manage energy behind the meter, the relationship becomes more dynamic: credits, exports, new services, new settlement logic. For example the Electricity Network Transformation Roadmap has estimated that by 2050 DER may contribute up to 45% of Australia’s electricity generation capacity.

Operational efficiency through automation. CIS-driven automation in core processes (billing runs, adjustments, service changes, collections workflows) is one of the most direct ways utilities improve execution and reduce back-office effort. And as this is part of digital transformation utilities initiatives, I have to mention here that utilities rank it as the 2nd most important innovation priority.

KEY DRIVERS

If you strip the buzzwords away, the drivers are consistent across EU/UK/US utilities:

Margin pressure and productivity. Leaders invest in modernization to improve operating performance and reduce avoidable work. Especially around billing, payments, and service processes. According to McKinsey, digital technologies can lead to a reduction in operating expenses of up to 25%.

Compliance and risk management. Regulations keep evolving (data privacy, metering requirements, consumer protection), and the fastest way to fail an audit is inconsistent processes and weak traceability in billing and adjustments. EY.com reports that regulatory volatility is accelerating and traditional compliance models are obsolete.

Customer experience expectations are rising. Customers want the basics done well (accurate bills, fast resolution), plus more personalization and real-time visibility into usage and costs, especially as energy becomes more volatile and choice expands. The Utility Innovation Survey makes this concrete: customer experience and engagement platforms rank among the top innovation priorities for utilities.

Cloud/SaaS and cyber-physical security. Utilities are moving toward cloud and SaaS models to gain agility and update speed, while also strengthening security for systems that sit close to critical infrastructure and customer data.

AI is becoming embedded, but governance decides if it helps or harms. Analytics and conversational experiences (like chatbots) can reduce workload and improve service, but only if you have clear policies on data access, auditability, and decision accountability. And to stress how important AI for utilities is, 96% of the respondents in the Utility innovation survey 2025 indicate that AI is currently a strategic focus.

Architecture is shifting from meter-centric to service-to-cash. With DER, EV charging, and new service models, utilities need event-driven, integration-ready CIS capabilities that support more than the traditional monthly billing cycle.

The energy and utilities sector is entering one of the most transformative periods in its history. Rising demand, aggressive decarbonization targets, new customer expectations, and rapid technological innovation are reshaping how we plan, operate, and invest.

💡 Is your utility company prepared for the future? Now is the time to modernize and optimize for long-term success. Methodia is here to help.