Electricity demand is climbing fast and this puts unprecedented pressure on utilities. Reportedly, global energy consumption is expected to rise 4% annually. Just the U.S. electricity demand is projected to grow by 25 % until 2030 and by 78% by 2050.

Global electricity consumption rose by nearly 1 100 terawatt-hours, while renewables already account for around a third of global power generation (32%).

At the same time, millions of rooftop solar systems, batteries, EVs, and smart devices are turning once-passive customers into active participants in the energy system.

For utility providers, this creates a tough balancing act: keep up with demand, meet rising customer expectations, comply with tightening regulations, and still hit sustainability targets, without compromising reliability or cost. On top of that, new market entrants and technology providers are chipping away at the traditional utility business model.

Below are the 10 key trends I believe will shape the utilities industry in the coming years.

1. Renewable Energy on the Rise

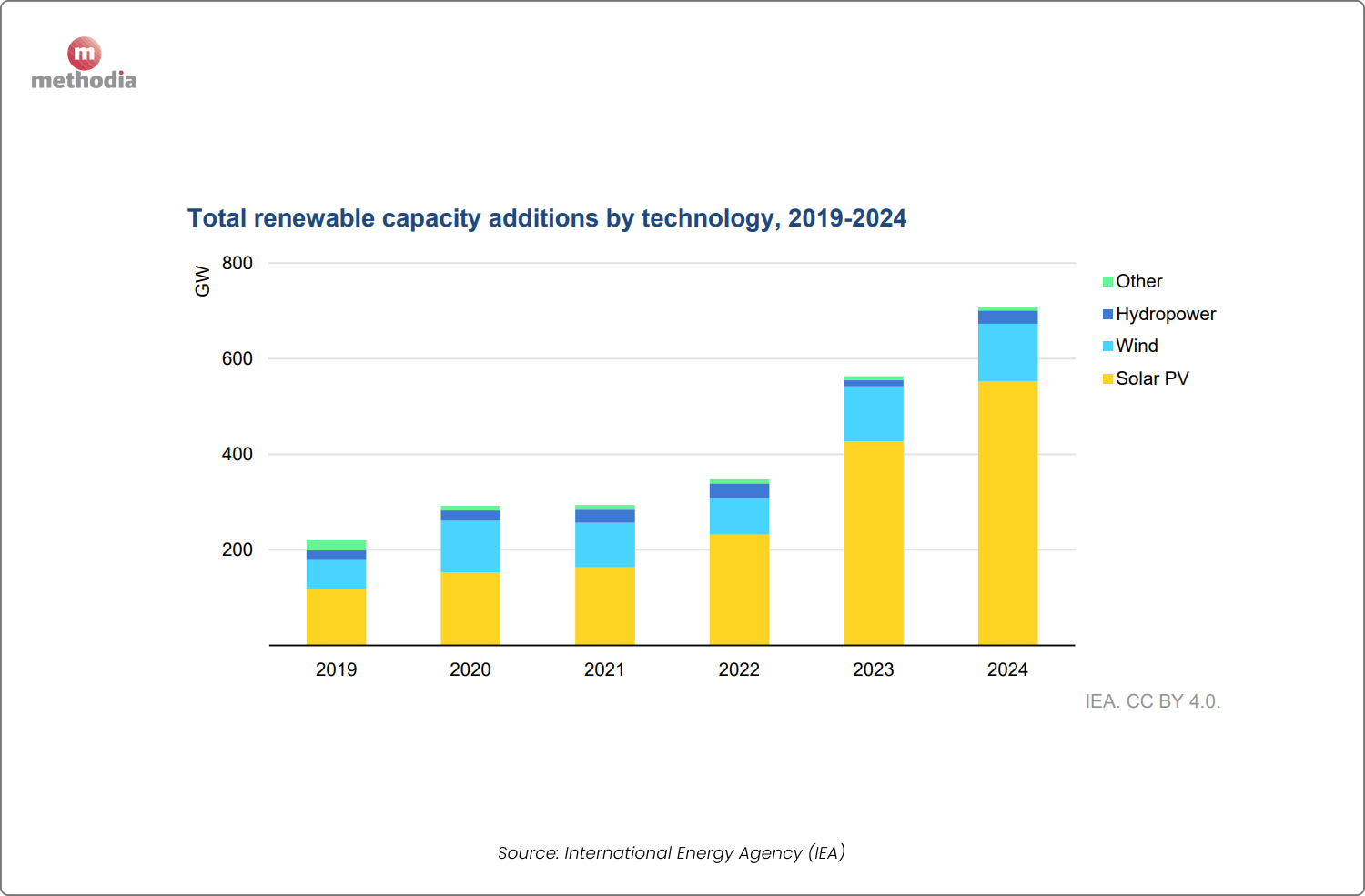

Renewables are now the cornerstone of the global energy transition. Solar and wind continue to scale at record speed, driven by cost reductions and policy incentives. The challenge for utilities isn’t generating renewable power. It’s integrating it.

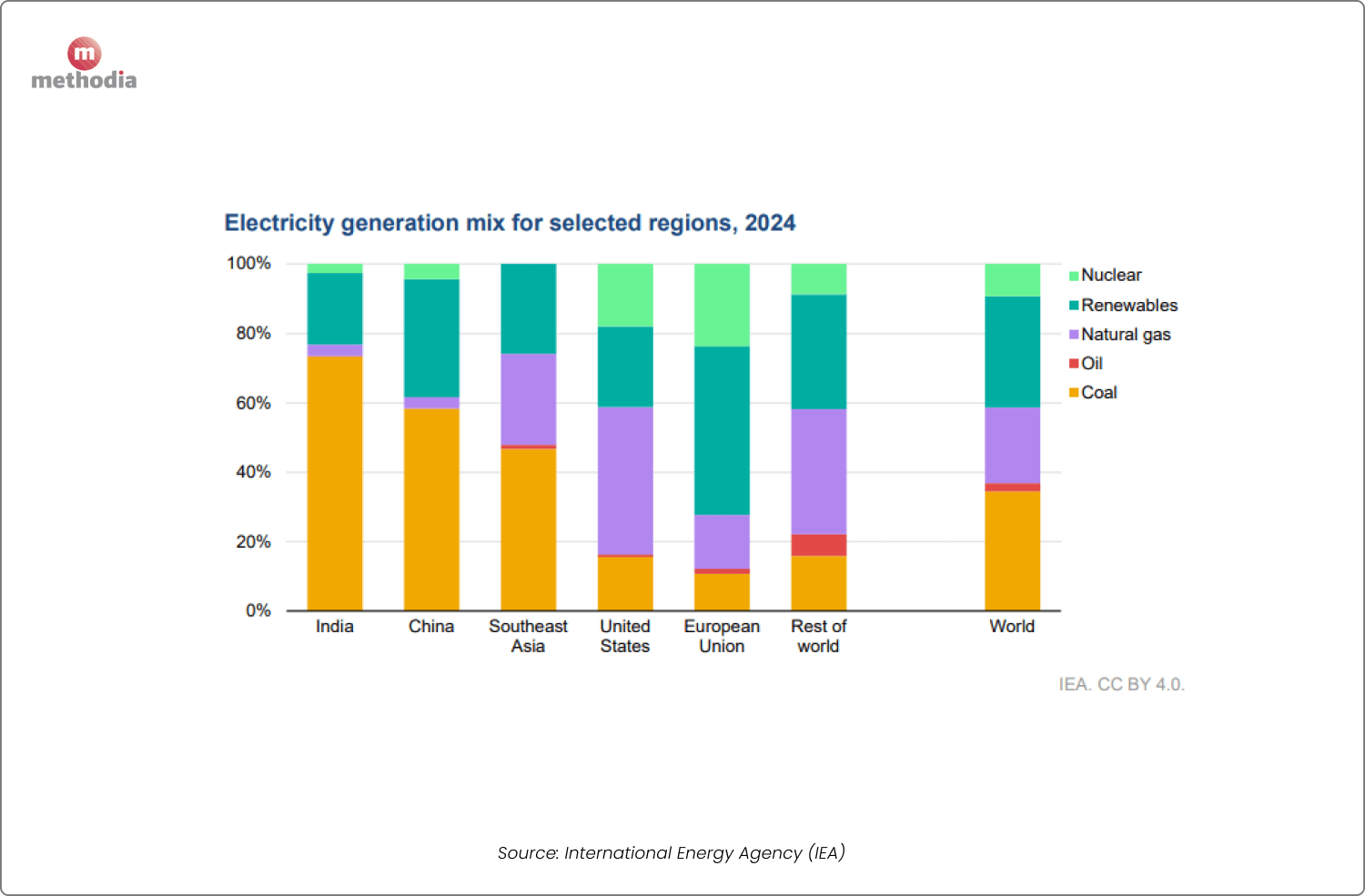

Currently, renewables and nuclear were responsible for 80% of the increase in global electricity generation, and together they supply 40% of total generation, with renewables alone accounting for 32%.

2. Solar and Wind Are Defining the Future Power Mix

When I look at where the new energy generation is really coming from, the story is very clear: it’s solar and wind.

In 2024, renewables are responsible for 32% of the global electricity generation. Nearly 80% of which is coming from solar, followed by wind power (17%).

For utilities, this isn’t just an interesting statistic. It has direct operational implications. We are planning networks for a world where most new capacity is variable solar and wind. That changes how we think about grid flexibility, storage investments, interconnection queues, and market design. The power mix of the future is already here; now the grid has to catch up.

3. Buildings Are Becoming the Largest Energy Consumers

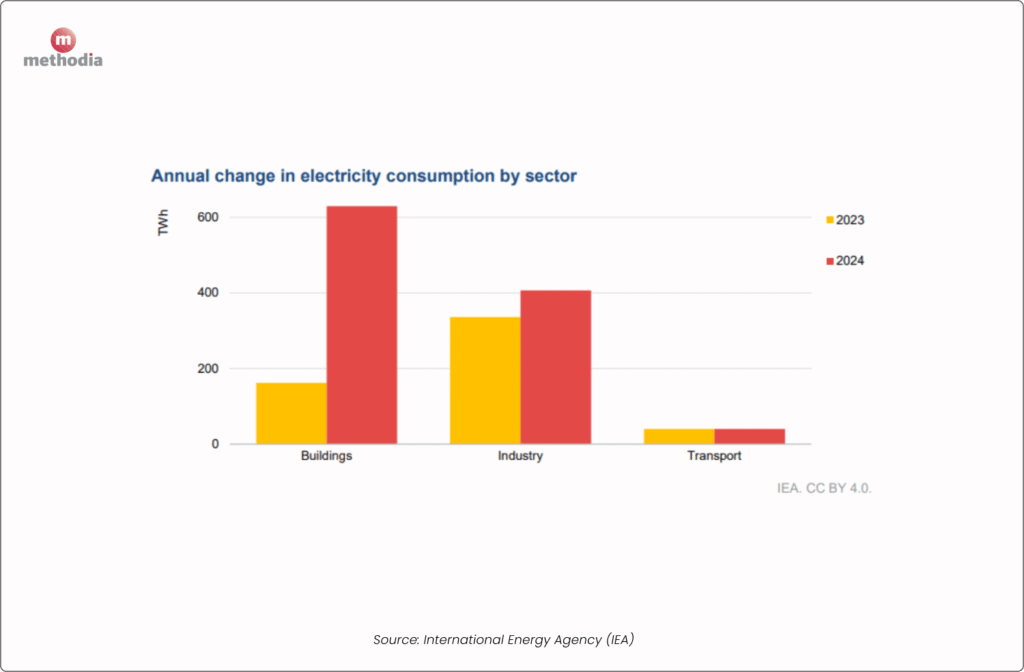

What often gets overlooked is just how much of the load comes from buildings.

Buildings already account for a major share of electricity use, and electrification is accelerating it further. Heat pumps, EV chargers, and smart appliances increase consumption, reshape peak patterns, and stress local distribution networks.

For the record, global electricity consumption in buildings increased dramatically in 2024, accounting for nearly 60% of total growth in electricity consumption.

For utilities, this means more localized planning, more data-driven load management, and more customer programs focused on efficiency and demand response. Buildings are no longer passive endpoints, they’re becoming dynamic grid participants.

4. Data Centers as a New Class of Mega Customer

Data centers used to be just another large industrial customer, but this is no longer the case. With AI, cloud computing, and high-performance workloads, data centers are turning into one of the most influential energy consumption players in many regions.

As the MIT Technology review reports, data centers in the USA used around 200 terawatt-hours of electricity in 2024, which is roughly the amount to power Thailand for a year.

Worldwide, data centers could reach 945 TWh in annual electricity consumption by 2030 and 50% of that demand growth is expected to come from U.S. data centers.

This will shift how utilities plan capacity, shape long-term agreements, and coordinate with developers, because data centers are no longer just big customers, they’re strategic partners that influence infrastructure investment decisions.

5. Distributed Energy Resources (DERs) Are Reshaping the Grid

The traditional utility business model is shifting, as more consumers become energy producers through rooftop solar panels, battery storage, and peer-to-peer energy trading. These “prosumers” are no longer just consuming the electricity produced; they are also selling excess energy back to the grid, changing the dynamics of power distribution and pricing. Only in the USA, it is believed that the cumulative distributed energy resource (DER) capacity increased with nearly 45% for the last 10 years.

Utilities that fail to adapt to this decentralized energy landscape risk losing market share to more flexible energy platforms that embrace consumer participation.

The ones that embrace DERs as grid assets, not threats, will be the ones that thrive.

6. Decarbonization and CO₂ Reduction Are Now Mandatory

While we are talking about initiatives such as “Climate-neutral Cities by 2030” and “Net-zero by 2050”, which are great by the way, the reality is slightly different.

The truth is that total energy-related CO2 emissions increased by 0.8% in 2024, hitting an all-time high record according to IEA.

Decarbonization targets are tightening around the world. Utilities must reduce emissions, accelerate clean energy deployment, electrify end uses, and support customers in reducing their own carbon footprint.

This drives massive shifts in investment planning, reporting, rate structures, and technology adoption. Decarbonization is no longer optional. It should define utility strategy.

7. IoT Is Transforming Utility Infrastructure

The IoT in utilities market is expanding fast, powered by smart meters, sensors, connected assets, and data streams that utilities simply couldn’t access before.

With IoT in place, utilities can monitor assets in real time, spot failures before they happen, and speed up outage response dramatically. It also gives far more accurate consumption data and helps optimize maintenance schedules instead of relying on guesswork. As our networks become more complex, IoT is quickly turning into the foundation for how modern utility operations run.

It is not a surprise that the IoT in the utilities market is currently valued at nearly USD 56 billion and expected to grow to USD 174 billion.

8. Energy Storage Is Becoming a Core Grid Asset

Energy storage used to be a nice-to-have; now it’s a necessity. Batteries smooth out renewable variability, support peak shaving, and strengthen grid resilience. We’ll see accelerated investments in:

– Utility-scale battery installations

– Long-duration storage

– Community storage programs

– Hybrid renewable + storage plants

It is worth mentioning here that Finland based company Polar Night Energy has built the world’s largest sand battery now that offers a storage capacity of 100 MWh. I expect to see many more projects of this kind in the coming years.

9. Digital Twins Are Becoming a Game Changer

If you are wondering what a digital twin is, here is the answer.

A digital twin is literally a dynamic, virtual replica of a physical asset, system, or process, such as an electricity grid, a power plant, or a pipeline.

They can use real-time data, sensors, and simulation models to let utilities see, predict, and optimize what’s happening across the grid, without touching the actual infrastructure.

Digital twins give utilities the ability to create virtual, real-time models of assets, substations, or even the entire grid. This allows them to simulate extreme weather, test DER integration, predict equipment failures, and optimize performance.

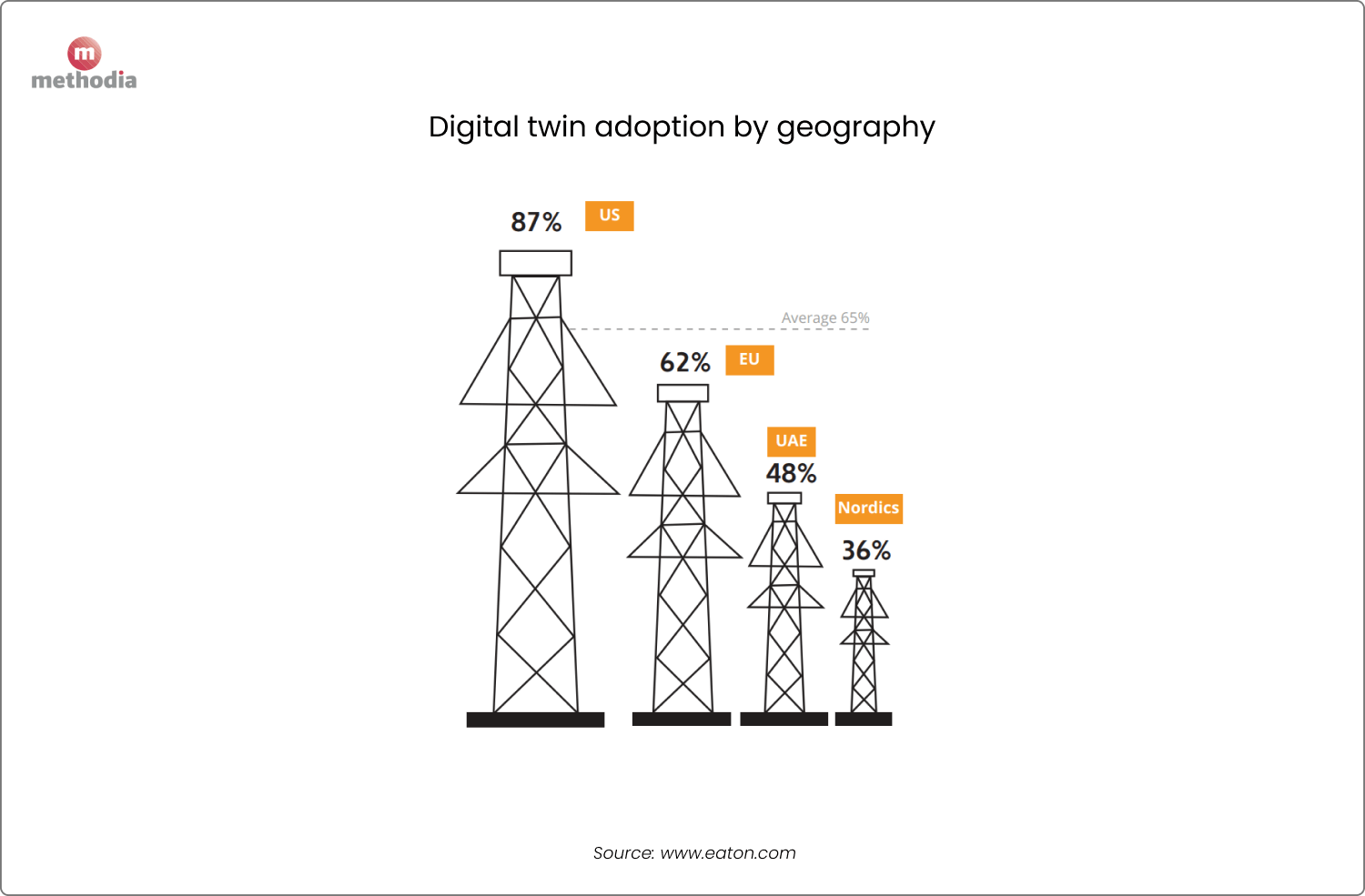

Recent research shows that nearly 65% of utilities say they have adopted digital twins.

In a world where complexity keeps rising, digital twins offer a risk-free environment to make faster, smarter decisions. For many utilities, they’re becoming a competitive differentiator.

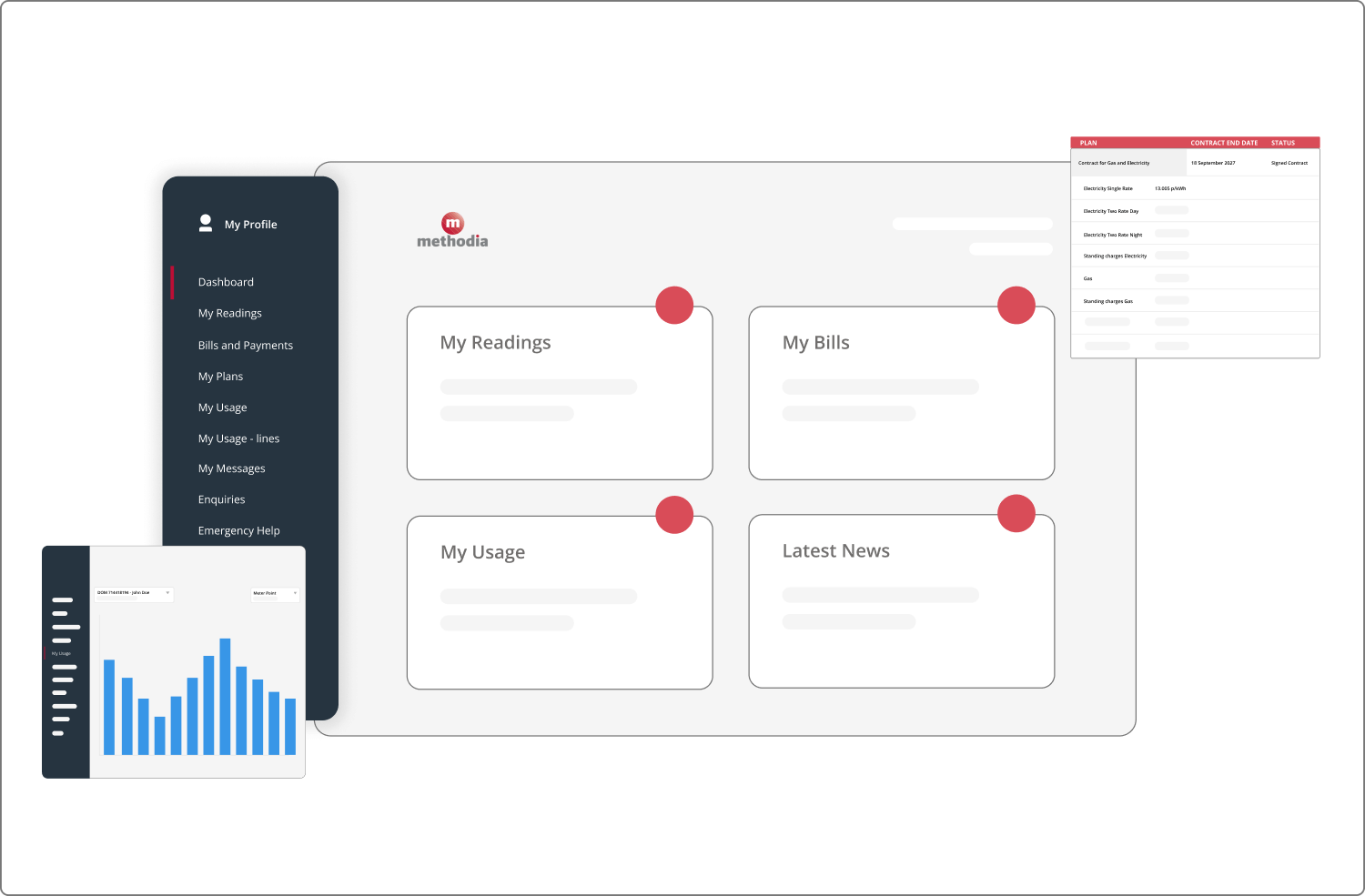

10. Customer Information Systems Are Key to Meeting Rising Customer Expectations

Recent research shows that the CIS for utilities market is rapidly growing as utilities seek modern, flexible solutions. Estimated at USD 12,750.45 million in 2024 and the market is projected to reach USD 25,643.90 million by 2032.

And this is understandable. The old systems can’t support dynamic pricing, EV tariffs, smart meter data, or customer self-service. On the contrary, modern CIS platforms help utilities improve accuracy, reduce revenue leakage, automate disputes, and deliver real-time consumption visibility.

This is why it is not a surprise that one of the top 5 utility sector digital drivers is capturing/understanding customer requirements.

Furthermore, 68% of providers now use utility billing software platforms to reduce operational inefficiencies and enhance customer satisfaction.

CIS integration is no longer just a back-office IT project. It sits at the core of the customer experience. Companies need a platform that can support accurate, transparent utility billing, handle complex pricing structures, and feed data into digital utility self-service portals. Customers expect to log into a portal or app, see their real-time or near real-time consumption, download invoices, change payment methods, and resolve simple issues without calling a contact center.

The energy and utilities sector is entering one of the most transformative periods in its history. Rising demand, aggressive decarbonization targets, new customer expectations, and rapid digital transformation are reshaping how we plan, operate, and invest.

The players that will win aren’t the ones who simply build more capacity. They’re the ones who modernize their infrastructure, use data and digital tools to run smarter grids, accelerate the rollout of renewables and storage, and treat customers as active participants in the systems.

The pressure is real, but so is the opportunity. The choices energy and utility providers make in the next few years won’t just define their competitiveness, they’ll shape the future energy system we all depend on.

💡 Is your utility company prepared for the future? Now is the time to modernize and optimize for long-term success. Methodia is here to help.