Everyone calls meter-to-cash a billing process.

The truth is that meter-to-cash is your operational control loop.

And in reality, if the truth is wrong or late, you don’t just get billing problems. You get fieldwork you didn’t need, angry customers, and missed revenue opportunities.

Most utilities don’t fail here because they’re incompetent.

They fail because meter-to-cash sits in the cracks between teams and systems. And very often nobody owns the cracks, but at the same time everyone suffers the consequences.

Meter-to-Cash Is a Loop, Not a Line

At first glance, meter-to-cash (M2C) looks simple.

Metering. Billing. Payments. Done.

In reality, that’s like saying “Winning the World Cup is easy: go, play, and win”.

M2C is a chain of identities, handoffs, and exceptions across multiple systems and teams.

And the moment one link lies, the whole thing turns into disputes, rework, and revenue leakage.

Indeed, meter-to-cash is exactly the kind of cross-team system where digital transformation stops being a slogan and becomes a coordination problem. So, if you’re serious about digital transformation in utilities, aim for modernizing the end-to-end flow, not just random systems.

Anyway, if we dig a bit deeper, we can see that the operational version is longer and less forgiving:

– Meter Reading: the capture of consumption data from the meter: manual reads, drive-by, or AMI (Advanced Metering Infrastructure) interval data.

– Head-end system (HES): this is where the data is shared with a head-end system (HES), which is the first system to receive meter data.

– Data Validation: after HES data is automatically sent to the MDMS (Meter data management systems), where the raw meter data is validated and processed, which includes handling exceptions and ensuring data integrity.

– Determinants and Rating: determinants are the inputs that shape charges like tariff rules, customer class, time-of-use windows, demand measures, multipliers, seasonal parameters, and special conditions. The rating applies these rules to validated usage to produce billable charges. If the determinants are wrong, the math can be perfect, and the bill still wrong.

– Bill Calculation & Invoicing: where raw usage data is translated into actual monetary charges. After this, the system formats the data into a readable invoice template, ensuring clarity, legal requirements (like tax breakdowns), and brand consistency are met.

– Customer Communication: in most utilities, the CIS (Customer Information System) is the system that assembles and delivers a big part of that story, as bill presentment, notifications, account messages, and the context agents rely on during calls.

– Payment: Incoming payments from various channels (bank transfer, direct debit, cash) are processed. Most often, the payment system is different than the customer information system.

– Collection and Revenue Protection: this is the controlled process for late payments: reminders, payment plans, notices, and escalation steps. Revenue protection covers theft, tampering, bypass, and irregular usage patterns.

– Dispute Resolution: this is the handling of high-bill complaints, meter accuracy questions, rebill requests, and payment disputes.

– Accurate records/Data warehousing: this is maintaining a clean, traceable history of reads, billing actions, adjustments, communications, and payments so you can support audits, meet regulatory requirements, and resolve disputes fast.

– Analytics and Reporting: using meter-to-cash data to spot operational and commercial issues early: read failures, estimation trends, abnormal consumption, revenue leakage, non-technical losses, and process bottlenecks.

As you can see, the process is not linear. It can go back and forth.

You can’t optimize one piece in isolation. If metering, validation, billing, and payments don’t line up end-to-end, you’ll keep paying for the same problems, just under different names.

Meter-to-Cash Is Not About Managing a Process. It Is About Reconciling Realities.

Meter-to-cash is the coordination and balance of three realities:

- – Operational reality (the network): what physically happened.

- – Customer reality (the premise and their usage): what they experienced and expect to pay for.

- – Cash reality (finance): what you can invoice, collect, and defend

You have to keep in mind that your systems represent these realities differently:

- – CIS (Customer Information System): customer, premise, service agreement, billing rules

- – AMI (Advanced Metering Infrastructure): interval reads + meter events

- – MDM (Meter Data Management): validate/estimate/edit (VEE) and store reads for billing

- – Payments: payment intake (card/ACH/bank), tokenization, posting files/APIs, refunds/reversals

- – OMS (Outage Management System): outages/restorations that affect usage and customer perception

- – SCADA (Supervisory Control and Data Acquisition): operational telemetry

- – GIS (Geographic Information System): spatial and connectivity truth

- – plus ERP, CRM, and field workforce tools

If these realities don’t align, meter-to-cash becomes a corporate sport: teams passing exceptions back and forth until the bill is “good enough”.

That’s the part nobody admits out loud: the process often exists to move uncertainty downstream until it becomes the customer’s problem.

What Are the Pain Points of the Meter-to-Cash Process?

Meter-to-cash doesn’t fail in one place.

It fails as a chain reaction: a small upstream issue turns into downstream cost, customer pain, and revenue risk.

So instead of random failures, I suggest thinking in four layers:

- – Identity (who/where/which asset)

- – Data flow and quality (reads arrive, make sense, and are usable)

- – Commercial logic (rates/determinants applied correctly)

- – Customer + cash (explain, collect, protect, and report)

- – Security (access, integrity, compliance, monitoring, and resilience)

1) Identity: when the system can’t agree on “what is what”

This is the quiet killer. If the meter, premise, service point, and customer relationship are incorrect, every downstream step can be technically correct and still produce the wrong bill. You see this after exchanges, move-ins/outs, and asset changes, especially when field updates don’t propagate cleanly into the CIS (Customer Information System) and meter data stack. The result is disputes that take weeks because you’re not debugging usage, you’re debugging identity.

Most of the time, this starts upstream as an asset workflow problem, which is why asset management software for utilities matters to meter-to-cash more than people think.

2) Meter reading: when data is missing, late, or from the wrong place

Meter reading looks simple until you run it at scale. Reads can be late, duplicated, missing, or tied to the wrong interval. In AMI (Advanced Metering Infrastructure) environments, “we have interval data” often hides a more operational truth: comms coverage isn’t uniform, meters drift, and outages create gaps. If your process depends on reads arriving by a certain window and you haven’t defined that window as an operational SLA, you’re choosing chaos every billing cycle.

3) Data validation: when VEE becomes a wall

Validation is where you decide what you trust. Too strict and you create a backlog that teams clear with rubber stamps. Too loose and you bill nonsense that only surfaces when customers complain. The most common failure is treating validation as one-size-fits-all. Different customer classes behave differently. Your validation rules need to reflect that or you’ll drown in exceptions and still miss real issues.

4) Determinants and rating: when the inputs are wrong, the math doesn’t matter

Determinants are the billing context: rate class, time-of-use, demand rules, multipliers, special agreements, taxes/fees, and eligibility flags. Rating is applying that logic to validated usage. These failures are brutal because they’re silent: the bill can look perfectly calculated and still be wrong due to one incorrect determinant. If you see repeated rebills or “why did my rate change?” calls, you often have a determinants governance problem, not a billing engine problem.

5) Bill calculation and invoicing: when exceptions get papered over

This is where utilities often just get the bill out. That mindset creates expensive downstream cleanup: adjustments, rebills, write-offs, and escalations. The failure mode is not arithmetic. It’s operational discipline: unclear thresholds, inconsistent approvals, and no shared definition of when a bill is allowed to be issued versus held for resolution.

6) Customer communication: when CIS can’t tell the story

Most customer frustration isn’t about the total; it’s about the explanation. Customers want a simple narrative: what changed, why it changed, and what you’re doing about it. The CIS is usually the front door for that story: bill presentment, account messages, notifications, and what agents see during calls. When CIS only shows charges without the upstream context (estimated reads, meter exchange, adjustments, known AMI gaps), agents stall, calls bounce between teams, and disputes go long.

7) Payment: when money arrives, but the account doesn’t reflect it

Payment is operational, not just financial. Posting delays and mismatches create false delinquencies, wrongful notices, and avoidable service actions. The failure mode is typically integration and reconciliation: payments come in through multiple channels, not all are matched cleanly, reversals are manual, and exception queues exist but aren’t owned like a true operational function.

8) Collections and revenue protection : when you’re either too soft or too strict

Collections fail when segmentation is poor, and the process is reactive. You either chase everyone the same way (customer backlash) or you chase no one effectively (aging grows). Revenue protection fails when tamper/theft detection isn’t connected to actionable workflows, meaning you produce insights but not recoveries. In both cases, the gap is the same: weak handoffs between analytics, customer operations, and field execution.

9) Dispute resolution: when “case management” becomes a waiting room

Disputes drag when you don’t have a standard playbook and a standard evidence pack. High-bill complaints then become custom investigations, which means inconsistent outcomes and slow resolution. The practical fix is boring and powerful: define what data must be reviewed first (identity, read quality, estimates, exchange history, adjustments), who owns each step, and when a field visit is justified.

10) Accurate records: when you can’t prove what happened

Analytics fails when it produces insights without triggers, thresholds, and owners. Reporting fails when definitions vary by department (“our estimation rate” vs “their estimation rate”), so leadership gets heatmaps instead of decisions. The fix is governance: agreed KPIs, single definitions, and operational actions tied to breaches.

11) Analytics and reporting: when dashboards replace ownership

This is the “we have data, but nothing changes” pain. Reports get produced, meetings happen, and yet estimation stays high, exceptions stay high, and disputes stay high. Definitions vary by department (“our estimation rate” vs “their estimation rate”), so leadership gets heatmaps instead of decisions. Without triggers, thresholds, and named owners, analytics becomes decoration.

And yes, this is also where AI in utilities shows up in real life: mostly for anomaly detection, better triage, and faster resolution when the basics are already in place. However, if your data quality is unstable, AI will mostly automate your mistakes.

12) Security: when “IT has it” replaces operational control

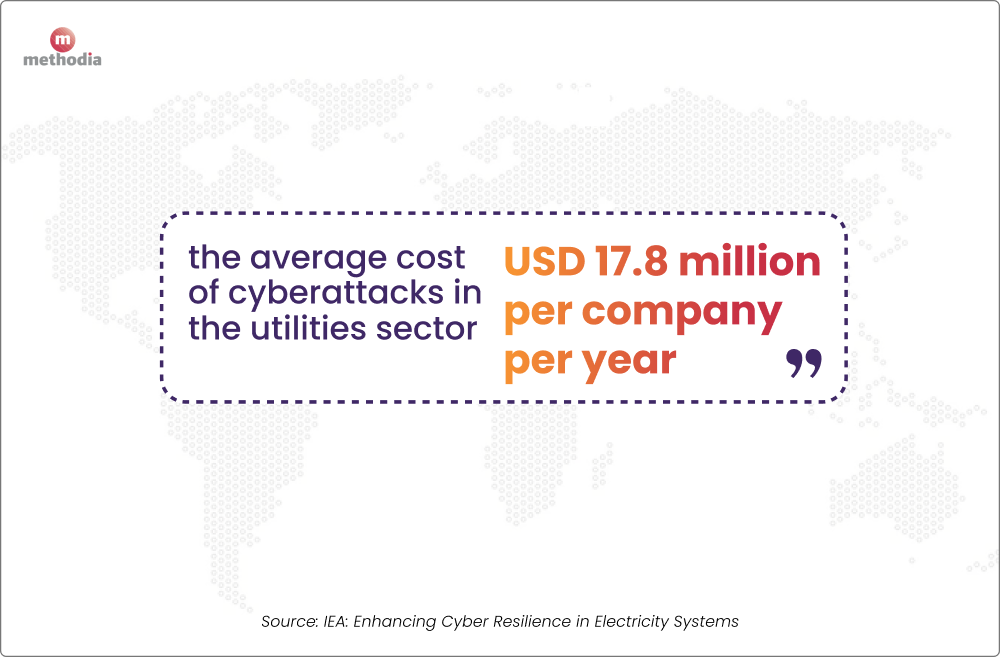

Before we continue with this last section, there is a very interesting statistic that each utility company has to take into consideration. In terms of the average cost of cyberattacks in various sectors, utilities had the second-highest average cost: USD 17.8 million per company per year. (IEA)

Data privacy concerns. Customer identity data is sensitive. If access isn’t tightly scoped and retention isn’t governed, you create regulatory and reputational risk even without a “hack.” The pain shows up as audit findings, legal escalations, and customers losing trust because you can’t explain who accessed what and why.

Data security. It usually doesn’t start with a dramatic breach. It starts with “normal” shortcuts: a vendor account that never expires, an admin role that’s way too broad, and an integration nobody monitors. Then something small hits: Reads stop arriving. Validation queues freeze. Billing misses its window. Customer service can’t see the account history. And by day three, you’re running the month on spreadsheets and favors.

Payment security. This usually breaks through small, everyday cracks.

You add a new payment channel. Then another. A new processor. A new portal. A call-center “take payment over the phone” tool. Each one works on its own. The problem is the seams between them.

Now, payment data and payment actions are spread out: who can see what, who can refund, who can reverse, who can change bank details, and who can override posting. Controls get inconsistent. Logging is partial. And nobody is fully sure where sensitive data lives anymore.

Conclusion: Run Meter-to-Cash like the System It Is

Meter-to-cash (M2C) looks like three boxes: metering, billing, and payments.

In practice, it’s a connected system: meter reading, validation, determinants and rating, invoicing, communication through the CIS (Customer Information System), payments, collections and revenue protection, dispute resolution, records, analytics, reporting, and security.

When it breaks, it rarely breaks in one place.

So don’t try to fix things as isolated projects.

Treat M2C as an operational control loop with one accountable owner, clear definitions of done, and exception handling that’s designed.

💡 Is your utility company prepared for the future? Now is the time to modernize and optimize for long-term success. Methodia is here to help.