TL;DR

As of 30 September 2025 (first trading day) for delivery on 1 October 2025, the EU’s Single Day-Ahead Coupling (SDAC) already calculates prices every 15 minutes instead of hourly. That means 96 price intervals/day (vs. 24), sharper price signals, better fit for renewables into the market, and more value for flexibility, storage, and demand response.

EU Day-Ahead Electricity Market (SDAC) Switched to 15-Minute Trading Intervals

After intensive testing, the European electricity market switched from hourly to 15-minutes market time unit (MTU) which is part of the Single-Day Ahead Coupling (SDAC) mechanism.

The transition covered all bidding zones and their borders, as confirmed by the All NEMOs Committee of nominated electricity market operators.

The transition from hourly to 15-minute trading in day-ahead and intraday markets aims to improve efficiency by matching production and consumption more accurately. The move improves Europe’s power system flexibility and reliability, preparing the grid for the growing share of renewable energy.

To really understand how trading actually works, let’s clarify the two energy markets.

What Are Day-Ahead vs Intraday Markets?

The key difference between day-ahead and intraday markets is timing: day-ahead trading covers electricity for the next day, while intraday market allows for trading within the same day.

In the EU, the day-ahead and intraday markets operate under two mechanisms:

- SDAC – Single Day-Ahead Coupling. The goal of SDAC is a unified, pan-European cross-zonal market for day-ahead electricity. The idea is simple: couple wholesale electricity markets from different regions via a common algorithm in order to allocate cross-border transmission capacity efficiently.

- SIDC – Single Intraday Coupling. The goal of SIDC is to create a single EU cross-zonal intraday electricity market. In short, market participants can work together across Europe to trade power continuously on the delivery day.

The 15-minute trading intervals for Intraday - SIDC

The SIDC cooperation was launched in June 2018 across 15 countries. In the first 16 months of operation over 25 million trades were completed across the countries involved.

- Wave 2, November 2019: 7 more countries joined.

- Wave 3, September 2021: 1 more countries joined.

- Wave 4, November 2022: 2 more countries joined.

As of March 2025, 25 countries went live on the 15-Minute MTU. The EU’s near-continent-wide deployment of the 15-minute MTU is a game-changer for electricity market design.

The shift enables the EU market to be more flexible, to balance production and consumption more accurately and to support a more sustainable future.

The 15-minute trading intervals for Day-Ahead - SDAC

The SDAC cooperation dates back to 2014. In February the same year the North-Western Europe (NWE) Price Coupling was launched operating under a common day-ahead power price calculation. At the same time the same solution was used in the South-Western Europe (SWE) region.

At the same time the 4M Market Coupling (4M MC) was established including: Czech Republic, Hungary, Romania and Slovakia.

In the following years NWE and SWE coupled via Multi Regional Coupling (MRC).

Since 17 June 2021 one single coupling is in place, namely the Single Day-Ahead Coupling.

Fast forward to 2025, all EU members are part of the SDAC creating a single pan-European cross zonal day-ahead electricity market.

Only Cyprus and Malta are not part of SDAC and SIDC due to their geographical location.

Why Does the 15-minute Switch in the Day-Ahead Markets Matter?

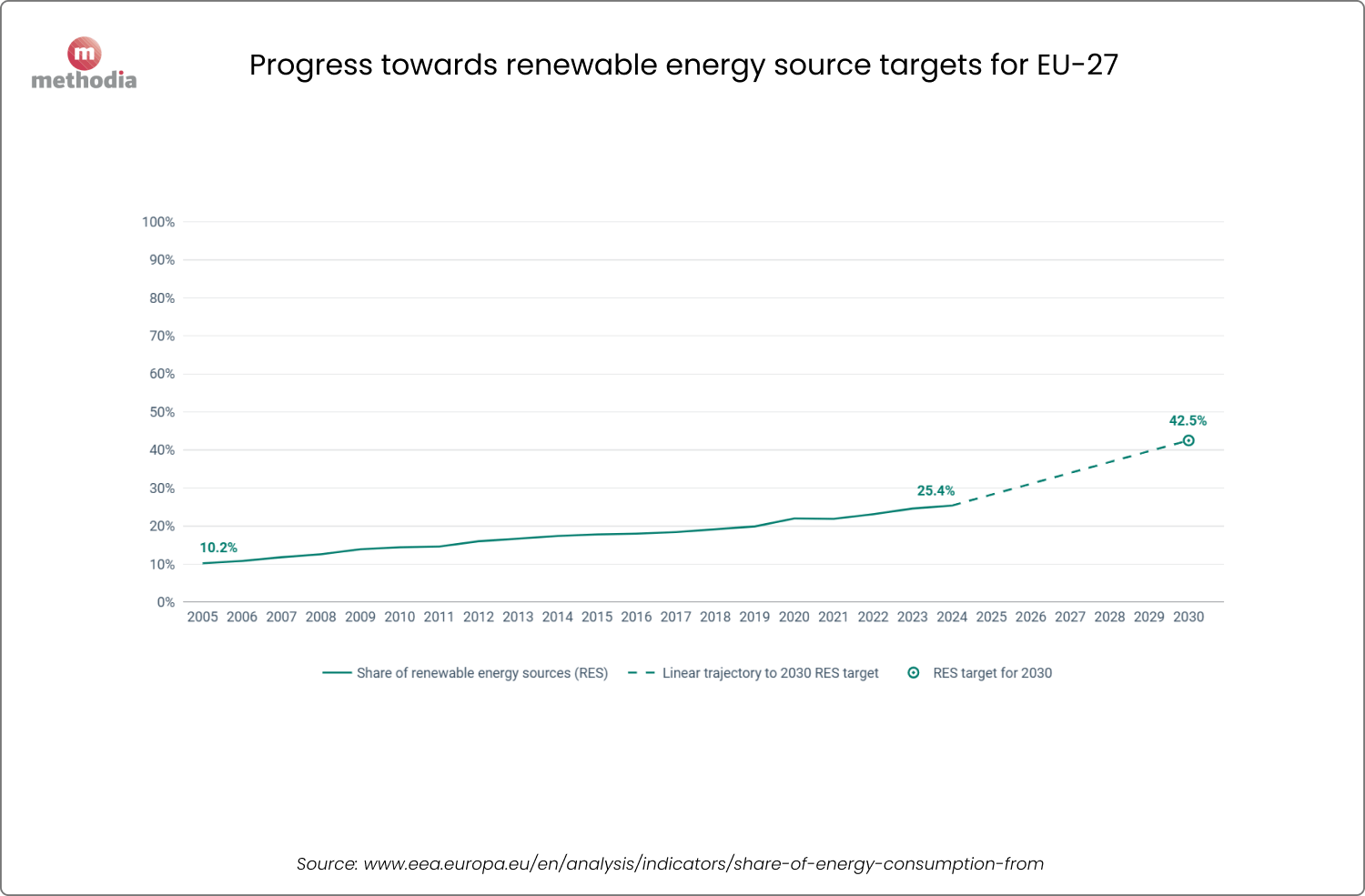

The renewable energy share in the European Union is steadily growing. It currently represents nearly 25% of the EU’s final energy use, targeting to reach 42.5% by the end of 2030.

As we all know, wind and solar energy production can be unpredictable, which can cause imbalances in the system.

This is why, with the rising share of renewable energy in the mix it becomes more critical to price and schedule electricity at 15-minute intervals, so markets reflect real-time swings in wind and solar.

What the Expected Benefits Are?

- Smoother renewables integration. With 15-minute intervals, operators can schedule and dispatch variable sources, like wind and solar, closer to how they actually change in real time.

- Stronger grid reliability. Finer time slices improve forecasting and balancing, cutting imbalances and helping keep the system stable.

- Higher market efficiency. Participants can trade at a more granular level, fine-tune their positions, and react faster to market signals.

What Changes Operationally?

According to the All NEMO Committee the shift to 15-minute intervals includes several key components:

Market Participation and Trading:

- – All NEMOs (Nominated Electricity Market Operator) will be required to offer 15-minute products for trading in the SDAC (Day-ahead market).

- – Market participants can submit bids to buy or sell electricity for 15-minute periods.

- – The Euphemia algorithm is upgraded to handle the increased number of bids and optimize price formation.

Clearing and Price Calculation:

- – The market coupling algorithm will match supply and demand at 15-minute intervals, ensuring the most efficient allocation of electricity across Europe.

- – Prices will be calculated separately for each 15-minute period, reflecting realtime conditions more accurately.

Cross-Border Trading:

- – The new 15-minute MTU will apply across all bidding zones and borders within the SDAC.

- – All shadow auctions currently organized by JAO (Joint Allocation Office) as a back-up solution will remain in 60-minute resolution.

- – TSOs (Transmission System Operators) will coordinate the cross-border electricity flows based on the updated market clearing results.

Integration with Balancing Markets:

- – The 15-minute MTU aligns with European balancing market reforms, where imbalance settlements will also move to a 15-minute resolution.

- – This synchronization ensures that deviations from forecasts are corrected more quickly, enhancing system reliability.

How Methodia Supports Energy Retailers in This New 15-Minute MTU Reality

As a purpose-built software platform for energy retailers, Methodia is ready to respond to the latest market changes and support industry players in moving through the transition smoothly.

Today’s Challenges Under the 15-Minute Trading Intervals Shift:

Data explosion: 4× more intervals (from 24 to 96 price intervals/day) → heavier ETL, storage, and QA load.

Tariffs & billing lag: Hourly products don’t map cleanly to 15-minute usage.

Forecasting & planning: Quarter-hour pricing turns small forecast misses into big costs.

Operations pressure: Bidding, scheduling, and settlement now run at a tighter cadence.

Customer communications: C&I clients want clear, transparent and granular information.

What Methodia Delivers Today

- Data integration & access: The software integrates with all types of meters and allows you to store, validate, and process 96 intervals/day end-to-end (meter reads, nominations, positions, costs) with anomaly detection for spikes and missing reads.

- Clarity and control for every customer. With Methodia you allow end consumers to see Quarter-hour prices, usage and compare different consumption periods. Furthermore, consumers can enter nominations for specific time periods and sites, view them in one place, filter by date/site/status. No messy spreadsheets.

- Billing and pricing accuracy. Methodia’s utility billing software helps energy retailers create QH tariffs, pass-through products, and blended ToU plans. You can bill accurately across 15/30/60-minute products and custom surcharges.

- Audit-ready settlement. When it’s time to bill and settle, we line up all the numbers at 15/30/60-minute level: what was forecast, traded, delivered, and invoiced, so disputes are easy to resolve.

- Better forecasting and planning. Price calculation will now cover 96 intervals/day, which means finer granularity and thanks to all the data in the system energy suppliers will be able to forecast and plan more precisely resulting in significant cost savings.